Buy Packaging Machinery Now: Get A Huge Tax Break!

Did you know that if you buy packaging machinery before the end of the year, you could get a huge tax break on that purchase? If not, you do now.

But, if you want to get that tax break, you are going to want to purchase your equipment as soon as possible. While you may think that is very bold of us and a bit salesy, that is not the case.

You will want to purchase packaging machinery today to get this significant tax break on your purchase because lead times for many types of packaging machinery are eight weeks or more in many cases.

Waiting a month or two to make a purchase may put you in the sorry position of missing out on these significant tax incentives.

And, if that were to happen, chances are, you do not want to be the person responsible for missing out on such an ample opportunity for your company.

But what are these incentives exactly? How do they work? Do you qualify for these tax write-offs? And what are the exact benefits that we are talking about here?

This article will answer all your questions about these fantastic tax breaks so you can complete your packaging machinery purchase before they are no longer available.

How Can You Get A Huge Tax Break By Buying Packaging Machinery Before The End Of The Year?

If you have continued reading this far, I will bet that we have caught your attention. I mean, who doesn't want to save money, am I right? Of course, I am!

I would imagine that you, like most people, love to save money for your business. And buying the packaging machinery you need for next year now will give you a unique opportunity to do just that!

But what are the details on these tax breaks, and how can you get them? Don't worry; in the section below, we will explain everything. You will have the information you need to proceed to get your excellent tax break.

How To Get A Huge Tax Break By Buying Packaging Machinery Before The End Of The Year

Thanks to a special tax incentive that we can offer through one of our financing partners, we can save you a ton of money if you purchase the packaging machinery you need ASAP!

Thanks to these offers, we can help you cash in big time with these special offers that will put a mountain of cash back into your bank account where it belongs.

So without further ado, let us jump into the details and help you reap these benefits before it is too late to claim your end-of-year packaging machinery tax breaks.

Want to know what your ROI will be for your packaging machinery purchase?

Buy Packaging Machinery Today To Cash In On The Tax Cuts And Job Acts Of 2017

Thanks to the tax cuts and job acts of 2017, you can secure a major tax break by buying packaging machinery before the end of 2022.

The acts provide businesses with these opportunities, including the following items:

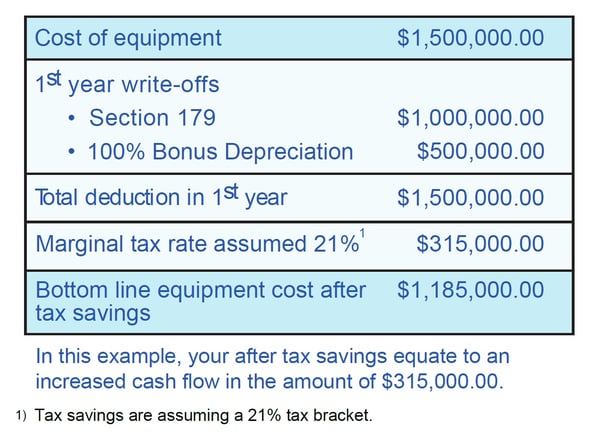

Under Section 179, businesses that spend less than $2,500,000 per year on qualified machinery can write off up to $1,000,000 upfront.

This incentive gives you 100% depreciation of bonuses on qualified machinery that you acquire and place in service from September 27, 2017, through December 31, 2022. Depreciation will fall to 80% in 2023, 60% in 2024, 40% in 2025, 20% in 2026, and expires in 2027.

Your $1,000,000 deduction from Section 179 will phase out when your business buys more than $2,500,000 in one year. It should also be noted that companies cannot write off more than their taxable income.

How Does This Incentive To Buy Packaging Machinery Benefit Your Business?

With these capital lease options, we can help your business take advantage of the aforementioned tax benefits by extending payments out as long as five years!

And your tax savings may be more significant than the amount of money paid in the first year of your capital lease. No matter how you look at it, this is a huge win-win opportunity for your business!

PLEASE NOTE: You will need to receive the equipment in the same year as the purchase is made to take the depreciation for that year.

PLEASE NOTE: 100% Bonus Depreciation on qualified equipment acquired and placed in service from September 27, 2017 through December 31, 2022. It falls to 80% in 2023, 60% in 2024, 40% in 2025, 20% in 2026, and expires in 2027.

How Do You Get This Tax Benefit When You Buy Packaging Machinery?

By now, you are probably wondering, where do I sign? If you are interested in learning more about these fabulous tax breaks that we can offer your business if you purchase packaging machinery today, you only need to do one thing.

Simply reach out to one of our in-house packaging experts. They will be able to answer all of your questions and help you to fill out the appropriate paperwork that will allow you to cash in on these sizzling offers!

The offer only gets smaller with each passing year. So, if you want to maximize your tax savings and get the biggest bang for your buck, don't hesitate.

Contact us today and get your huge tax break when you purchase packaging machinery from Industrial Packaging today!

About Nathan Dube

As the Digital Marketing Specialist at Industrial Packaging, I am honored to create content for such a phenomenal company and work with one of the greatest teams in the Packaging Industry. Whether creating a video, writing blog posts or generating other pieces of content and multimedia, I am always excited to help educate and inspire our prospects and clients to reach their highest potential in regards to their packaging processes and needs.